What Took So Long? Finally, Some Help For Homeowners

What Took So Long? Finally, Some Help For HomeownersMore than four months after the federal government claimed it was moving to address a mortgage crisis that threatened to take away the homes of millions of American families, steps are being taken to do just that.

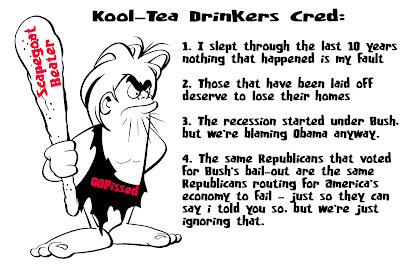

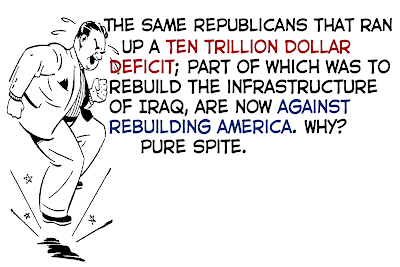

All that was required was the exit of a president (George Bush) and a treasury secretary (Hank Paulson) who, in the best interpretation, were too economically inept to do what was needed, and, in the worst interpretation, used the crisis to steer hundreds of billions of dollars into the accounts of their buddies on Wall Street.

Whatever the cause of the delay, President Obama on Wednesday offered the response that was needed -- or, at the very least, a piece of the response that was needed.

The president proposes to take administrative actions to spend $75 billion of the Financial Stabilization Fund on facilitating modifications in existing loans and he wants to require lenders that are accepting tax dollars to adopt foreclosure prevention protocols to prevent unnecessary foreclosures.

These are meaningful steps.

Indeed, ACORN (Association of Community Organizations for Reform Now), the national organization that has been in the forefront of the struggle to keep working families in their homes -- and has taken a lot of hard hits in the media and Washington for doing so -- refers to Obama's move of Wednesday as "the first federal effort to fight foreclosures since the crisis that brought down the economy began two years ago."

The president's ambitious plan could help as many as nine million American families that are currently struggling to make mortgage payments or whose homes are now worth dramatically less than the amount they paid for them. The housing plan uses incentives to homeowners and lenders to ease and encourage the process by which home loans can be restructured or refinanced to avoid foreclosure.

"The plan I'm announcing focuses on rescuing families who have played by the rules and acted responsibly," says Obama, who added that the plan would do this "by refinancing loans for millions of families in traditional mortgages who are underwater or close to it; by modifying loans for families stuck in sub-prime mortgages they can't afford as a result of skyrocketing interest rates or personal misfortune; and by taking broader steps to keep mortgage rates low so that families can secure loans with affordable monthly payments."

That's the right sentiment, even if the precise strategy adopted by Obama tends to reward banks and bankers that acted irresponsibly. (More on savvier approaches in a moment.)

This is not a particularly new notion, however.

Federal Deposit Insurance Corporation (FDIC) chair Sheila Bair was promoting a plan to modify mortgages last fall.

Had the Bush White House and the Department of the Treasury listened to Barr -- and to members of Congress such as California Democrat Maxine Waters -- back then, hundreds of billions of dollars might have been saved. And the dollars that were spent might have actually gone to address the real crisis, as opposed to the demand from Wall Street for money to pay bonuses, bail out speculators and keep stockholders happy.

"In the end, all of us are paying a price for this home mortgage crisis. And all of us will pay an even steeper price if we allow this crisis to continue to deepen," Obama explained in Phoenix, where he announced his initiative. "But if we act boldly and swiftly to arrest this downward spiral, every American will benefit."

We should have acted "boldly and swiftly" -- and in a fiscally-responsible manner -- last fall. Hundreds of wasted billions later, we finally are. For that, Barack Obama and his administration deserve a good deal of credit -- just as George Bush and his administration deserve a great deal of blame.

The lesson is an important one.

Focus on the people who are hurting -- not the bankers who are threatening them -- first.

To do that, Ohio Congressman Marcy Kaptur and economist Dean Baker have some smart ideas. They argue that the proper role for the federal government is not to fund mortgage negotiations but to insist that banks -- many of which have already collected billions in taxpayer dollars -- carry them out.

Short of that step, ACORN head Bertha Lewis proposes a short-term ban on mortgage foreclosures during the period when the Obama administration is implementing its plan and seeking legislative approval for key components of it.

"With 8 to 9 million Americans on the verge of losing their homes in the next four years, the nation's housing crisis demands leadership commensurate with its enormous scale, and we got that today from the Obama Administration," says Lewis. "These effective sticks and carrots will do the job that the previous all-voluntary efforts have failed to do, and help prevent millions of unnecessary foreclosures once fully operational and enacted in law. Until that time, however, there should not be a single foreclosure on any family that could benefit from this comprehensive housing plan, so we need a thorough, binding moratorium."